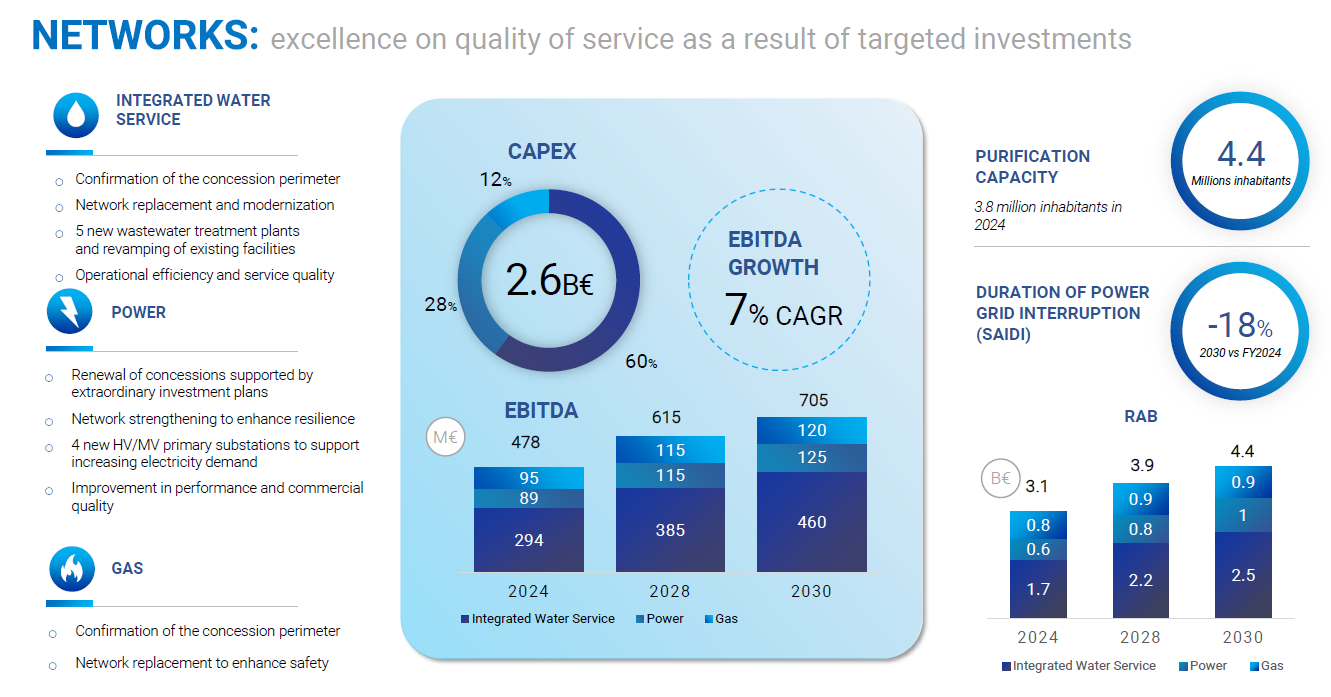

The investment plan envisages Euro 2.6 billion to increase the efficiency and quality of services with strong growth in invested capital (RAB), which will reach Euro 4.4 billion in 2030. Of the investments, 60% are for integrated water service, for upgrading and increasing the resilience of the network, developing purification plants and improving the quality of service. 28% of the Networks business unit's investments are directed towards electricity distribution to enable the evolution of infrastructure, adapting it to support greater resilience to climate change and the increase in installed power demand linked to the electrification of consumption, continuously pursuing operational efficiency necessary to provide an improvement in service, also in terms of reducing supply interruptions. 12% of the Networks business unit's investments are directed towards gas distribution, in particular aimed at maintaining the current infrastructure in the relevant territories, and completing the plan to replace pipelines, thus also making them ready for the distribution of hydrogen mixtures.

The planned investments and synergies allow for an EBITDA of Euro 705 million in 2030 (+Euro 230 million compared to 2024), equivalent to +48%.